BATTERY RECYCLING - AUSTRALIA

Battery recycling progress in Australia

By Mark Hull, VP Sales, APAC, Superfy, 11 December 2023

Batteries play an important part in a circular economy as well as sustainability initiatives. From optimising energy consumption and facilitating renewable energy sources such as solar and wind, when used correctly, batteries are a help rather than a hindrance. Particularly in Australia, there is a key focus on battery usage as well as upholding sustainability pledges across multiple areas such as waste management, renewable energy, and how citizens understand and process waste within their homes.

The Battery Stewardship Council recently produced a Battery Market Analysis document, highlighting the latest market data for the battery industry in Australia. Within this report, research into the Australian battery market also builds on previous findings in 2018, giving a 5-year insight into elements such as battery sales, stocks, and flows. It also identifies the scale of the quantity of batteries that will reach their End-of-Life (EoL) over the coming decades.

In this article, I will look at some key results within this report, with a specific focus on the smaller batteries (<5kg) as well as the future of the battery industry in Australia overall.

A quick overview of the Australian Battery Market

Australia’s role within the battery supply chain is predominantly within battery material mining and refining, whilst having some involvement in domestic battery recycling capacity. However, recycling is a significant area of future growth as more battery materials will be required to be recycled. Once batteries reach EoL they can be enrolled into another recycling process to maximise usage.

Australia is also ranked tenth in the world for battery consumption in 2021, and is a nation highly dependent on batteries, from consumer devices through to powering homes and businesses.

The Australian battery market is made up of four overarching market segments – Handheld batteries (<5kg), Battery Energy Storage Systems (BESS), Electric Vehicle batteries (EV) and Starting Lighting and Ignition (SLI) batteries.

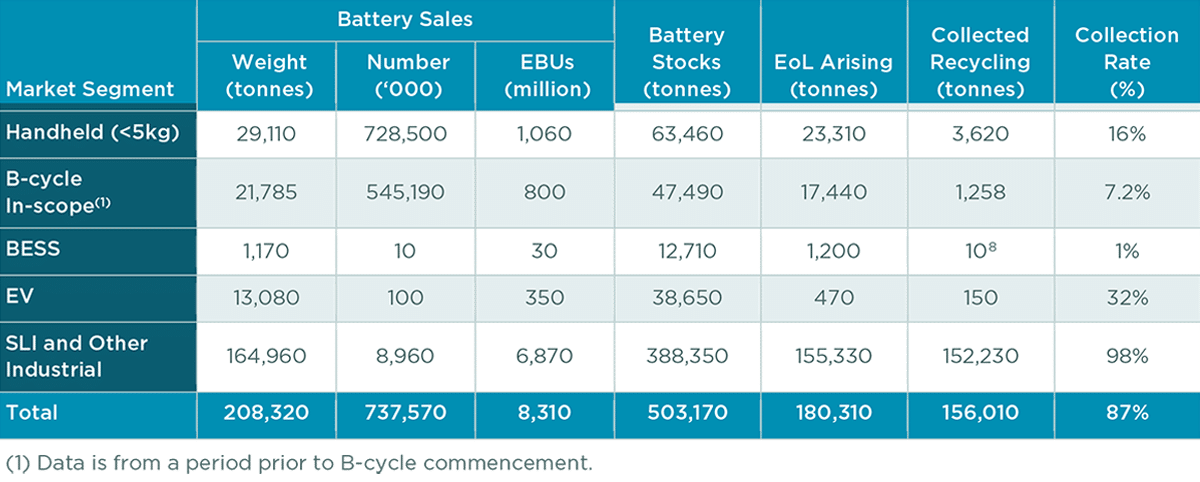

As per the Table below, while Handheld (<5kg) batteries represent just over 10% of the weight of batteries sold in Australia, they cover the majority of numbers of batteries sold.

Overview of Australian battery flows by market segment (2021)

Source: Battery Stewardship Council

Key statistics:

The detailed report captures some interesting data on battery usage and recycling in the country:

- A total of 737 million batteries were sold onto the Australian market in 2021, which represents 8,313 million Equivalent Battery Units (EBUs) and equates to just over 200,000 tonnes of batteries.

- A total of 156,000 tonnes of batteries were estimated to be collected for recycling in 2021, which equates to a collection rate of 87% across all battery sizes.

- A total of 545 million batteries sold in Australia in 2021 would have been within the scope of B-cycle. B-cycle in-scope batteries represent just over 10% of the tonnage of batteries sold, at 21,785 tonnes.

Handheld <5kg batteries

The Handheld <5kg category covers a wide range of batteries, including consumer electronics (cameras, laptops, mobile phones, tablets, waste, etc…), torches, power tools, toys, e-bicycles, emergency lighting, alarms as well as street lighting.

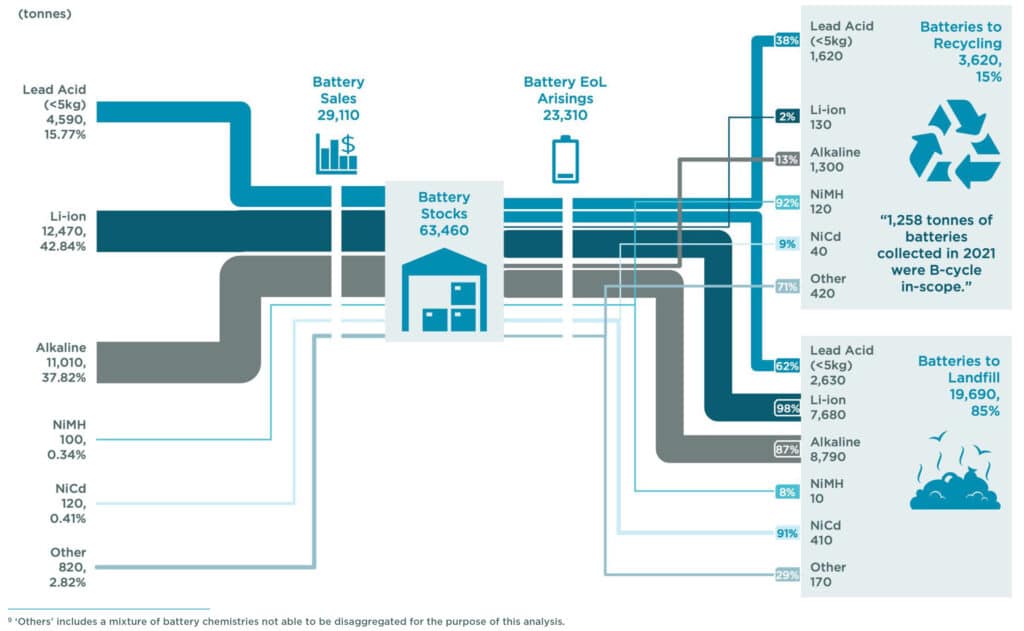

Lithium-ion batteries made up the major share of battery sales for this category (43%), and Alkaline batteries followed at a close second (38%). When looking at the overall Australian battery sales, a total of 728 million Handheld batteries were sold in 2021, representing 99% of all batteries sold, and 14% of batteries sold by weight (29,110 tonnes).

The Battery Stewardship Council report indicates an increase in the collection rate for Handheld batteries under 5kg from 11% in 2018 to 16% in 2021.

Handheld under 5kg battery flows (2021)

Source: Battery Stewardship Council

Handheld <5kg battery recycling

The good news from a recycling perspective, is that the report indicates an increase in the collection rate for Handheld batteries under 5kg from 11% in 2018 to 16% in 2021. However, this rate is much lower than the total average with an estimate of almost 20,000 tonnes of batteries for this category assumed to end up in landfill in 2021.

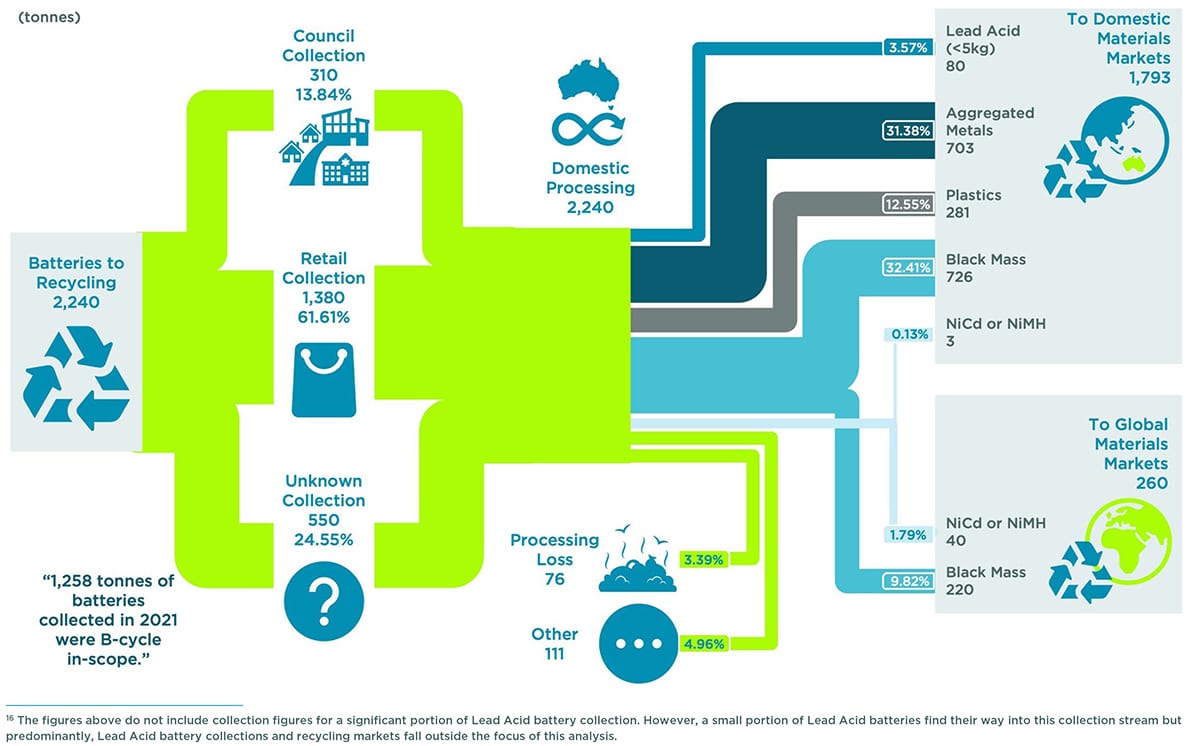

A breakdown of the recycling data shows that over 60% of the batteries collected for recycling were deposited at retail collection points, while 14% were delivered to a council collection point.

A breakdown of the recycling data shows that over 60% of the batteries collected for recycling were deposited at retail collection points, while 14% were delivered to a council collection point.

Handheld under 5kg battery flows (excluding Lead Acid Batteries) recycling fates (2021)

Source: Battery Stewardship Council

As the data shows the B-cycle scheme is on a positive trajectory, but there is clearly more to be done to avoid batteries ending up in landfills.

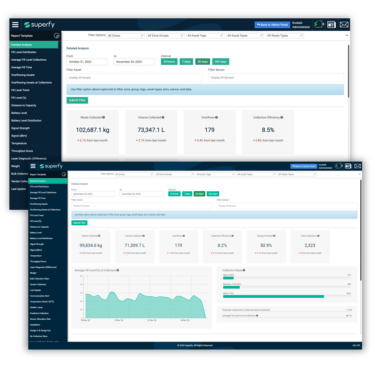

Superfy’s battery collection system used by Ecobatt, an accredited collector, recycler and sorter in the B-cycle scheme, has played a key role in the increase to date.As covered in a case study, our technology has been used to collect over 1,000 tonnes of handheld batteries, representing a significant.

The future of the battery industry in Australia

Looking to the future, the report highlighted some key future growth indicators of significance:

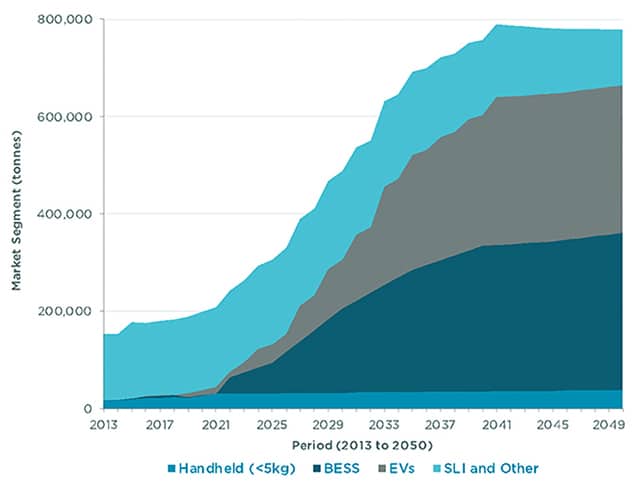

- The tonnage of Handheld batteries sold onto the Australian market has increased by around 33% between 2018 and 2021, with a much smaller year on year growth rate of 1%– 2% projected until 2050.

- The total tonnage of BESS and EV batteries sold is projected to grow between 10% and 40% year on year until 2030. A greater increase in BESS systems is expected between now and 2030 which reflects the considerable uptake of battery storage to support a growing portion of solar and wind in the Australian electricity mix.

- Total battery sales are projected to reach 778,293 tonnes by 2050, as presented in the chart below. Projections have increased by around 25,000 tonnes from 2018 estimates due to a larger than expected increase in battery sales between 2018 and 2021.

- Demand for Lithium-ion batteries is projected to increase steeply between now and 2040, driven by large demand for this fast-charging chemistry with a long lifetime.

Projected battery sales from 2021 to 2050 by market segment (2013-2050)

Source: Battery Stewardship Council

Superfy’s battery collection system used by Ecobatt, an accredited collector, recycler and sorter in the B-cycle scheme, has played a key role in the battery recycling increase to date.

It’s clear that Australia is incredibly focused as a nation on sustainability and creating a more circular economy. The demand for batteries will always be there; however, it’s all about ensuring that the disposal and circularity of batteries – regardless of size – is front of mind. This is a joint effort, from those within their homes through to corporations who manufacture them.

Find out how Superfy can help your Waste Management requirements. Contact a sales representative now.